Graphite Miners News For The Month Of June 2020

Seeking Alpha – 27 June 2020 Summary:

China graphite flake-195 spot prices were only slightly higher in June.

Graphite market news - Benchmark Mineral Intelligence forecasts that by 2029 demand for flake graphite will increase by four times.

Graphite company news - Ceylon Graphite first commercial graphite sale. Mineral Commodities announces Skaland record sales in Q1. Talga Resources looks to expand battery anode capacity. SRG Mining signs off-take.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to the June edition of the graphite miners news. June saw graphite prices only slightly higher and plenty of good news; notably from some of the smaller graphite producers and juniors.

Graphite price news

During June, China graphite flake-195 EXW spot prices were up 0.23%, and are up 8.3% over the past year. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries.

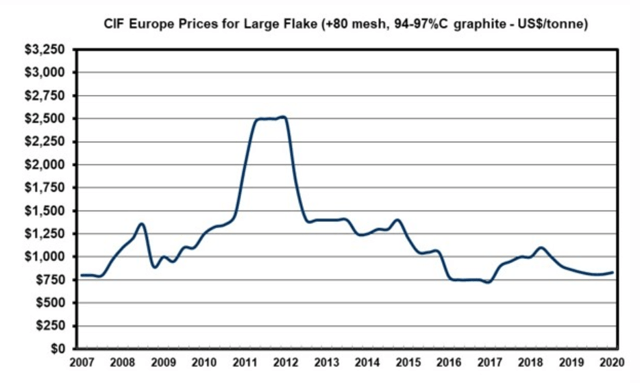

Graphite price chart - Large flake graphite price is ~USD 830/t (slightly out of date now, but a good indication still)

Source: Northern Graphite

A reminder of a 2016 Elon Musk quote:

"Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide."

In my January 30, 2018 Trend Investing Interview with Benchmark Minerals Simon Moores, he said about graphite:

"Spherical graphite anode plants, predominately based in China, were traditionally 5-10,000 tpa but now we are tacking four megafactories are looking to produce 60,000 to 100,000 tpa from 2020 onwards."

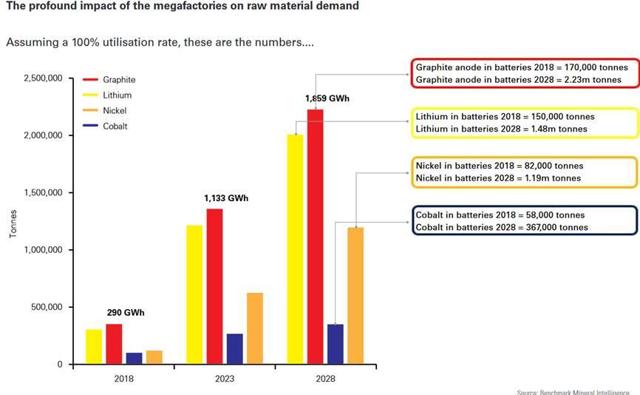

The impact of the proposed megafactories on raw material demand (graphite in red)

Source: Benchmark Mineral Intelligence

Graphite market news

On June 5, Fastmarkets reported:

"Global steel demand to drop 6% in 2020 due to Covid-19, Worldsteel says. Global demand for steel will decrease by 6.40% year-on-year in 2020 due to the effects of Covid-19 pandemic lockdown measures."

On June 19, Mining Weekly reported:

"Electric vehicle rally to maintain demand for battery metals despite Covid-19. Although subdued as a result of Covid-19, demand for battery metals, including cobalt, lithium and copper, will remain strong as a result of growth in the global electric vehicles [EVs] market, business intelligence company CRU UK cobalt, lithium and battery markets senior analyst George Heppel said this week... However, Heppel pointed out that, interestingly, although the automotive market as a whole had been hit hard by Covid-19, the EV sector had actually had a few good months, all things considered."

On June 22, New Atlas reported:

"Pre-loaded silicon anodes boost lithium battery density by 25 percent... swapping the graphite for silicon, which can store four times the amount of lithium ions, could lead to phones that last for days or cars that travel hundreds of miles further on each charge. But working silicon into a lithium-ion battery that makes the most of this potential has proven problematic. One of the ways that this could be overcome is through a technique known as “lithium pre-loading." Rather than adding lithium powder, the team submerged the silicon anode in a special solution for five minutes, which triggered a chemical reaction that sees electrons and lithium ions seep into the electrode. A test battery constructed with the silicon anode was shown to have an energy density 25 percent higher than a comparable commercially available battery with a traditional graphite anode. The team says this technology has the potential to increase the range of electric vehicles by a minimum of 100 km (62 mi) on average, and would be fairly easy to implement for large-scale processing."

On June 24, Investing News reported:

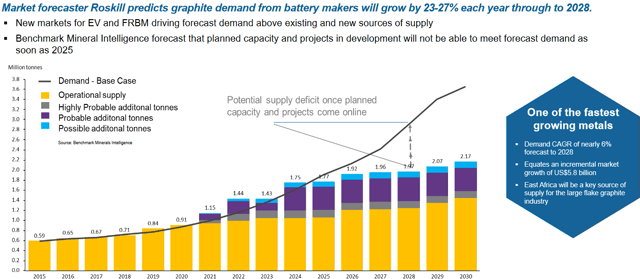

"Simon Moores: US domestic supply chain build out “far too slow”. “It is not too late for the US, but action is needed now,” Simon Moores of Benchmark Mineral Intelligence told the US Senate on Tuesday. “A new global lithium-ion economy is being created,” Moores said. “Yet any US ambitions to be a leader in this lithium-ion economy continue to only creep forward and be outstripped by China and Europe.” Looking at the raw materials needed to supply that lithium-ion economy, Benchmark Mineral Intelligence forecasts that by 2029, demand for nickel will double, while demand for cobalt will grow by three times, flake graphite by four times and lithium by more than six times."

Graphite demand versus supply forecast

Source: Triton Minerals courtesy Roskill

Graphite miner news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include - Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: Imerys Graphite and Carbon (OTC:IMYSF) and AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) are also "diversified producers", producing graphite. SGL Carbon (OTCPK:SGLFF) is a synthetic graphite producer.

Syrah Resources Limited [ASX:SYR][GR:3S7](OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique.

On June 12, Syrah Resources announced: "S&P DJI announces June 2020 quarterly rebalance." Syrah Resources was removed from the ASX 300 Index.

You can view the latest investor presentation here, and the Chairman's May 2020 AGM address here.

Bass Metals [ASX:BSM] [GR:R2F] (OTC:BSSMF)

No news for the month.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has 'Vein graphite' production out of one mine in Sri Lanka with 121 square kilometers of tenements.

On June 3, Ceylon Graphite announced:

"Ceylon Graphite announces first commercial sale of 95-97% natural graphite. Ceylon Graphite Corp. is pleased to announce its first sale of graphite from its wholly owned subsidiary, Sarcon Development [PVT] Ltd (“Sarcon Development”), since the commencement of commercial production in December 2019. The sale, which was for 1 ton of vein graphite with Carbon content of 95-97%, was to 2D Materials Pty Ltd (“2D Materials”) of Singapore. 2D Materials purchased the graphite to evaluate it for its graphene production needs. The shipment is expected to ship immediately... "This is the next step in accelerating our production rate to enable us to fulfill the needs of multiple customers.”"

On June 5, Ceylon Graphite announced:

"Ceylon Graphite enters Korean market. The sale, which was for 300 kgs of vein graphite with carbon content of 95-97%, was to Elves Graphite Co, Ltd of Seoul, South Korea. The graphite was purchased to evaluate its suitability for battery manufacturers and other industries who use high-grade graphite in their manufacturing processes in South Korea. The shipment is expected to ship immediately. “...We hope we will see sizeable orders shortly.”"

Mineral Commodities Ltd. ("MRC") [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe, with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC owns 90%.

On June 12, Mineral Commodities Ltd. announced: "Covid-19 and market update." Highlights include:

Tormin

- "The Company is pleased to announce that the Section 102 Expanded Mining Rights application has progressed to the Department of Mines Resources and Energy (“DMRE”) in Pretoria for granting. The Company advises that the delays experienced to date have been due to closures of DMRE offices as a result of the nationwide lockdown measures resulting from COVID-19."

Skaland

- "The Company’s Norwegian mining operations and downstream program continued without major interruption arising from COVID-19. The Company continues to assess options to develop processing capabilities."

Sales

- "Graphite sales at Skaland have continued uninterrupted with the Company recording record sales in the first quarter as product inventory accumulated in 2019 was sold down."

GMA Garnet

- "The Company continues to produce and meet minimum contract deliveries of 210,000tpa under its Life of Mine Garnet Offtake Agreement with Garnet International Resources Pty Ltd and GMA Garnet [USA] Corporation (“GMA Group”)..."

Graphite developers

Magnis Energy Technologies Ltd. [ASX:MNS] (OTC:URNXF) (formerly Magnis Resources)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world's largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On June 3, Magnis Energy Technologies Ltd. announced: "Land amendments progress Townsville Lithium-ion Battery Plant." Highlights include:

- "Townsville City Council has now formally adopted an amendment to its planning Scheme, allowing the iM3TSV project to progress.

- The Scheme will allow the Development Application [DA] to be lodged in the coming months.

- Discussions with investors continues following significant interest in the project."

Eagle Graphite [TSXV:EGA] (OTC:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

Battery Minerals [ASX:BAT] [GR:0FS]

Battery Minerals core commodity targets are graphite, zinc/lead and copper. BAT is maintaining a focus on its two graphite development assets Montepuez and Balama which are located in Mozambique.

No news for the month.

You can view the latest investor presentation here.

Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Mason Graphite is a Canadian graphite mining and processing company focused on the development of the Lac Guéret project located in northeastern Quebec, where the graphite grade is believed by management to be among the highest in the world.

No significant news for the month.

You can view the latest investor presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has three large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On June 22, Triton Minerals released: "Developing world-class projects for the graphite revolution. Positioned to utilise its first mover advantage in one of the fastest developing markets globally."

China’s 2025 goals build on the cleaner and greener environmental goals of 2020 and continue to focus on energy saving and new energy vehicles – both requiring significant graphite supply

Source: Page 5

You can view the latest investor presentation here and an excellent video here.

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that's developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property.

No news for the month.

Investors can view the latest company presentation here. You can watch the company's Senior Vice President Brent Nykoliation video interview here.

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern’s principal asset is the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

No news for the month.

You can view the latest investor presentation here.

Talga Resources [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Resources Ltd. is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On May 27, Talga Resources announced:

"Battery anode agreement with Farasis Energy. Australian battery anode provider Talga Resources Ltd. is pleased to advise the Company has entered an agreement with Farasis Energy Europe GmbH (“Farasis”), a subsidiary of Farasis Energy Inc., one of the world’s leading manufacturers of lithium-ion batteries... Talga is building a European anode production facility for lithium-ion batteries using the Company’s proprietary material technologies, wholly owned Swedish carbon source and 100% electricity from renewable energy sources. As part of the agreement between Talga and Farasis (“Agreement”), Talga will supply coated (‘active’) anode products for evaluation in Farasis batteries and assessment of potential business development opportunities, primarily in Europe."

On June 18, Talga Resources announced:

"Vittangi Project supported by national interest demarcation. Battery anode and graphene additives company Talga Resources Ltd. is pleased to advise of positive developments at its 100% owned Vittangi graphite project in northern Sweden (“Vittangi”). A recent decision by the Swedish Geological Survey (“SGU”) completed the demarcation of Vittangi as a mineral deposit of national interest. This designation adds support to consider the exploitation of Vittangi as a mineral deposit when government authorities review development plans and any potential competing land uses."

On June 24, Talga Resources announced: "Talga looks to expand battery anode capacity." Highlights include:

- "Expressions of interest received for Talga’s lithium-ion battery anode products exceed 300% of planned annual capacity of the Vittangi Anode Project.

- Talnode products now in 36 active commercial engagements covering majority of planned European Li-ion battery manufacturers and 6 major global automotive OEMs.

- Talga expanding scale of Niska Scoping Study as a result of this significant interest.

- Li-ion battery megafactories set to require >2,500,000tpa active anode material by 2029, up from ~450,000tpa anode production today, with Europe the fastest growing market."

You can view the latest investor presentation here.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] (OTC:SRGMF) [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

On May 25, SRG Mining Inc. announced:

"SRG Mining signs additional offtake agreement bringing total sales to 85% of production. The Company has recently signed its 5th offtake agreement for 10,000 tonnes per year for a three-year period. This brings the total signed off-take agreements to 128,000t over three years. These agreements represent approximately 85% of the Company’s anticipated production over that period. Our clients operate in various markets including refractories, expandable graphite and battery anode material. We remain actively engaged with several potential clients to continue to sign off-take agreements for our graphite production. The Company continues to believe in signing sales agreements for the anticipated production and having many potential clients test and qualify our material. These efforts will remain ongoing throughout the life of the Project."

On June 11, SRG Mining Inc. announced:

SRG Mining signs additional offtake agreement bringing total sales to 90% of production. SRG Mining Inc. today provides an update on recent activities related to its Lola graphite project (the “Project”). The Company has recently signed its 6th offtake agreement for 8,000 tonnes over a three-year period. This brings the total signed off-take agreements to 136,000t over three years.

On June 19, SRG Mining Inc. announced: "SRG Mining Inc. announces AGM results."

You can view the latest investor presentation here.

Link: https://seekingalpha.com/article/4355960-graphite-miners-news-for-month-of-june-2020